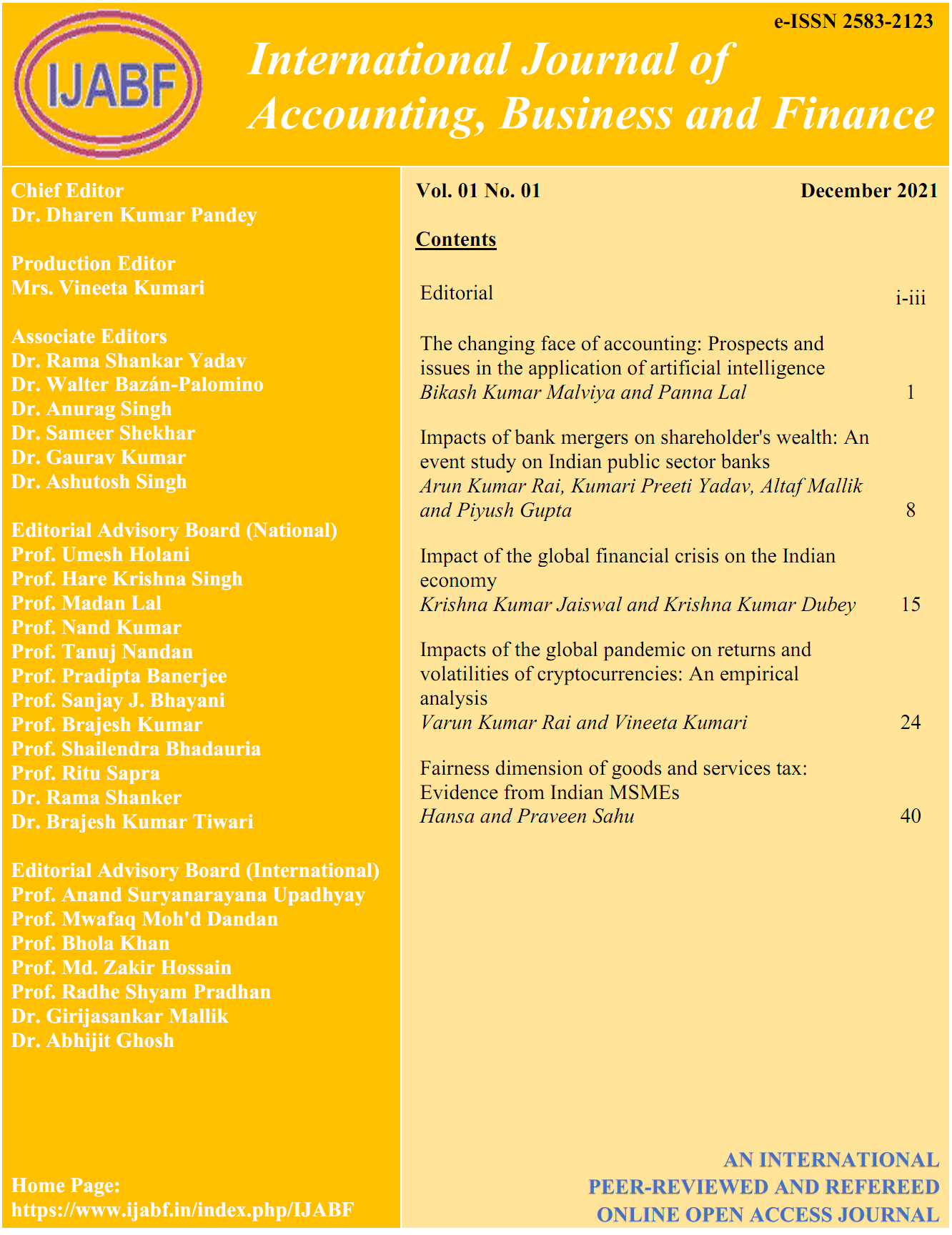

Impacts of the global pandemic on returns and volatilities of cryptocurrencies

An empirical analysis

DOI:

https://doi.org/10.55429/ijabf.v1i1.21Keywords:

Event study, covid-19, pandemic, cryptocurrency, abnormal return, volatilityAbstract

Employing the standard event study methodology and the OLS market model to examine how the global pandemic announcement impacted cryptocurrencies, we test the null hypotheses that "the global pandemic declaration did not significantly impact the abnormal returns of the cryptocurrencies", and "during the global pandemic declaration, the cryptocurrencies did not experience any significant abnormal volatilities". The average abnormal return on t-2 was nearly minus 40 percent, which is the highest negative value during the 61-day event window. The cumulative average returns are significantly negative during the event window. The global pandemic news has significantly impacted cryptocurrencies and are more volatile during the outbreak. The study's findings will empower the investors to implement proper investment strategies during emergencies.

Downloads

Published

Versions

- 01-01-2022 (3)

- 30-12-2021 (2)

- 30-12-2021 (1)

How to Cite

Issue

Section

License

Copyright (c) 2021 Varun Kumar Rai, Vineeta Kumari

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

This is an open-access journal. Your article will be published open-access, but you will not have to pay an APC (article processing charge) - publication is free. Your article will be published with a Creative Commons CC BY-NC 4.0 user licence, which outlines how readers can reuse your work. The licence terms may be found at https://creativecommons.org/licenses/by-nc/4.0/.

Accepted 2021-12-29

Published 2022-01-01