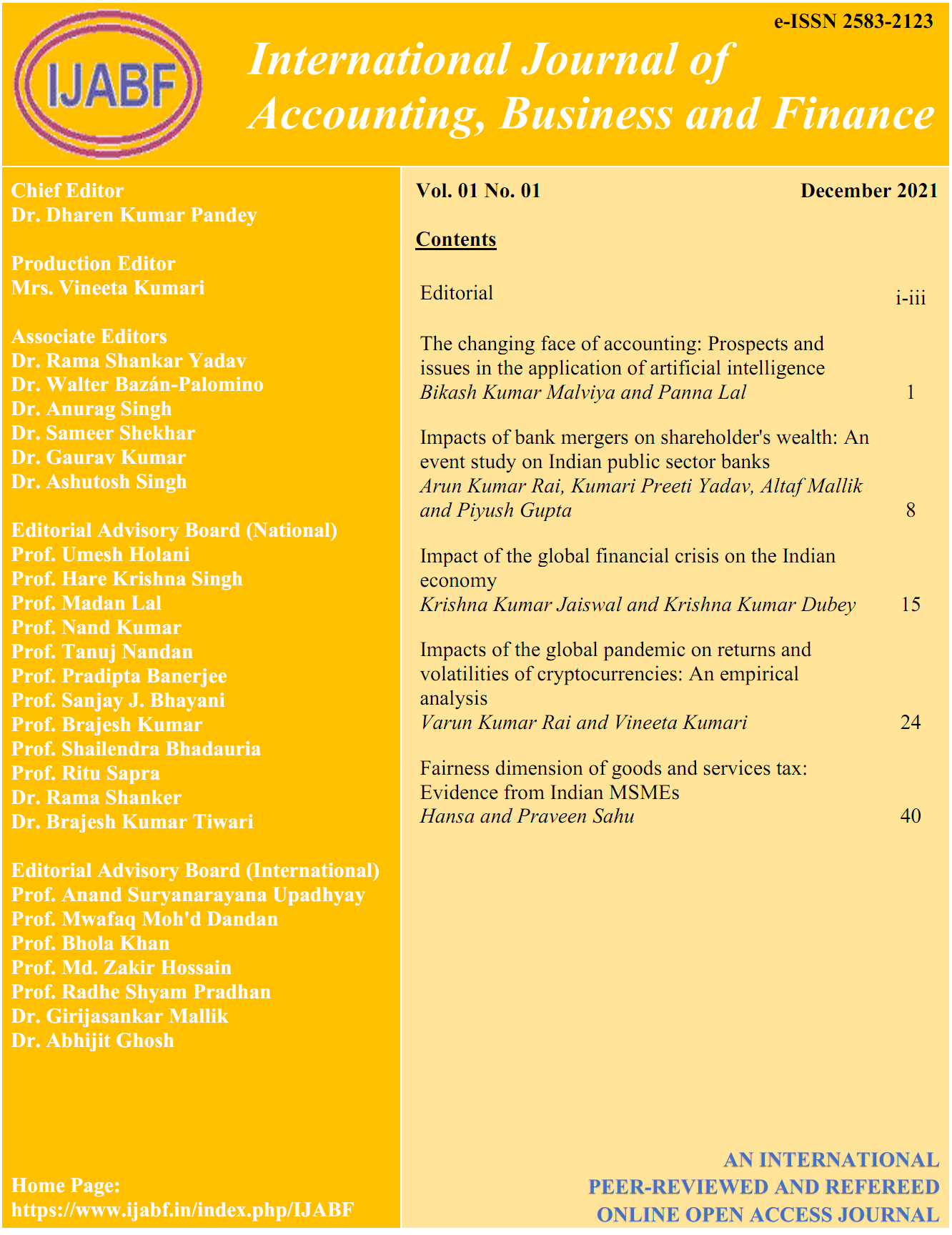

Fairness dimension of goods and services tax

Evidence from Indian MSMEs

DOI:

https://doi.org/10.55429/ijabf.v1i1.19Keywords:

Tax fairness, goods and services tax, tax compliance, taxationAbstract

A tax system to be called fair must assess the tax liability of each tax-payer without any biases. Most studies suggest a positive relationship between tax fairness perception and compliance behavior. This relation can only be ascertained if the factors of tax fairness are known. This study investigates the dimensions of tax fairness in India concerning the recently implemented Goods and Services Tax (GST). A survey questionnaire on tax fairness was developed and administered to a sample of 210 business people belonging to the micro, small, and medium enterprises (MSME) sector. Measures of central tendency, factor analysis, and reliability analysis identify five robust tax fairness dimensions: General Fairness, Exchange with Government, Process Equity, Inter-Group Equity, and Tax Rate Structure. By identifying the dimensions of tax fairness, the perception of tax-payers can be understood, and the factors leading to tax evasion can be curbed.

Downloads

Published

Versions

- 01-01-2022 (2)

- 30-12-2021 (1)

How to Cite

Issue

Section

License

Copyright (c) 2021 Ms. Hansa, Prof. Praveen Sahu

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

This is an open-access journal. Your article will be published open-access, but you will not have to pay an APC (article processing charge) - publication is free. Your article will be published with a Creative Commons CC BY-NC 4.0 user licence, which outlines how readers can reuse your work. The licence terms may be found at https://creativecommons.org/licenses/by-nc/4.0/.

Accepted 2021-12-30

Published 2022-01-01